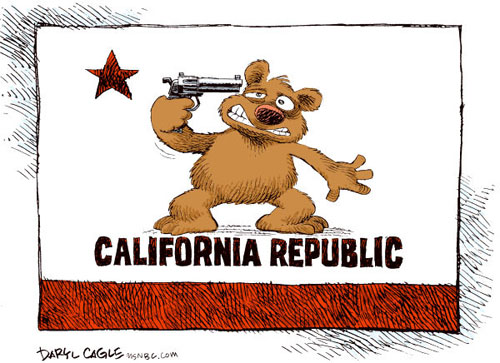

California Budget Suicide. Cartoon by Daryl Cagle.

May 24, 2010

An $11.1 billion Water Bond Proposition now on the November ballot would pay for the overhaul of California’s aging and overburdened water system. If passed by the voters, the bond will ultimately cost taxpayers $22 billion when interest is included. Putting aside the merits or demerits of the bond measure, can California, now in a budget crisis, afford it?

How bad is the problem? Governor Schwarzenegger says California’s budget deficit will reach $41.8 billion by the budget year ending in June 2010. This probably means more deep cuts in education, health, social services, corrections, and transportation. California owes $8.8 billion in short-term loans that have to be paid off by June and over $120 billion in outstanding bonds and interest that will be paid over decades. The state’s pension fund, CalPers, has $16.3 billion more in liabilities than assets, plus California faces a $51.8 billion for the health and dental benefits of state retirees and future retirees.

California now has the lowest credit rating of any state in the nation, just above junk bond status. One major problem is the rise in California’s debt-service ratio (DSR). That is, the ratio of annual general fund debt–service costs to annual general fund revenues and transfers. This is often used as one indicator of the state’s debt burden. The higher it is and more rapidly it rises, the more closely bond raters, financial analysts and investors tend to look at the state’s debt practices, and the more debt–service expenses limit the use of revenues for other programs. According to the California Legislative Analyst’s Office, debt servicing is projected to comprise 9 percent of general fund revenues by the end of 2014-15.

The over 9 percent DSR is considerably higher than it has been in the past. In part, this reflects the sharp, recent fall–off in general fund revenues, which drives up the ratio for a given level of debt service. To the extent additional bonds are authorized and sold in future years beyond those already approved, the states debt–service costs and DSR will be higher. As of October 30, 2009, the LAO reports that California has $66.5 billion of outstanding general fund debt and over $64 billion of authorized, but unissued general fund bonds.

Until California’s fiscal house is put in order, or at least a fiscally-sound budget passes, the prudent course may be to avoid taking on new debt, even for ostensibly worthwhile projects such as the 2010 $11.1 billion Water Bond Proposition. Voters should keep this in mind when considering whether to vote for the Water Bond Proposition in November.

The Hunger Site

The Hunger Site

May 25, 2010 at 5:57 am

I note that groups like the Sierra Club, Clean Water Action, Environmental Justice Coalition on Water and Food, and Water Watch among others, oppose the Water Bond Proposition because they believe it is not only bad fiscal policy, it is also bad water policy.