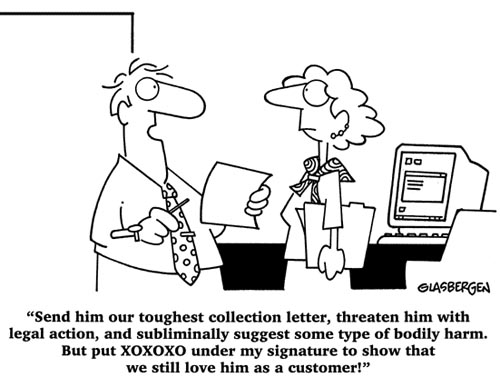

Cartoon by Randy Glasbergen.

February 3, 2012

Last year, California State Senator Lou Correa (D-Orange County) was sued for a $4,000 debt owed by an unrelated “Luis Correa,” and learned of the lawsuit only after his wages had been garnished. Sear’s billing department had handed the original debt off to LVNV Funding LLC, a debt-collection clearinghouse, which in turn hired the Brachfield Law Group to collect the actual debt. Brachfield sent numerous letters to Luis Correa that went unanswered. The company then apparently decided to stick it to Lou Correa instead. The senator sent numerous letters to Sears and Brachfield explaining they had the wrong Correa. Those letters went unanswered, too. Then came the order to garnish the senator’s wages.

Senator Correa shared his horror story with his Senate seat mate Mark Leno, the San Francisco Democrat, who drafted Senate Bill 890, “The Fair Debt Buyers Act,” aimed at helping those in the same predicament as Senator Correa.

Collection agencies and their attorneys file hundreds of thousands of lawsuits every year in California, many of which are filed against debt-free individuals such as Senator Correa with no connection to the original creditor. Incredibly, these lawsuits rarely include the information needed to prove the claim is legitimate, because current law doesn’t require it. Consequently, innocent Californians wind up with a judgment on their record or have their wages garnished because they were sued for someone else’s debt.

SB 890was introduced by Senator Leno in the 2011-2012 session, which, among other things, would prohibit a debt buyer from making any written statement in an attempt to collect a consumer debt unless the debt buyer has valid evidence in the form of business records that the debt buyer is the sole owner of the specific debt at issue, the amount of the debt, and the name of the creditor at the time the debt was charged off. This is a commonsense reform that will protect Californians.

As a volunteer for Consumer Action and ABC-TV Channel 7, 7 On Your Side consumer hotline, and as a former attorney for the Federal Trade Commission, I can attest that many complaints concern the abusive tactics by debt collectors, especially during the current downturn in the economy. In fact, in 2010, the FTC, which enforces the Fair Debt Collection Practices Act (FDCPA), received over 33,000 complaints alleging that debt collectors attempted to collect a debt that the consumer did not owe, or was larger than the amount the consumer actually owed. These errors are not always due to honest mistakes by collectors. Instead, they too often are the conscious decision made by many debt-buying companies to save money by not bothering to obtain the necessary documentation about the alleged debt. They then sign documents they haven’t read and use fake signatures to provide phony verification when the legitimacy of a debt is challenged by consumers under the FDCPA. In this way, debt buyers can enhance their profits at the expense of many innocent consumers who are harassed or even endure frivolous lawsuits by collection attorneys.

Creditors sell or assign debts to collection companies because they simply don’t have the time or resources to hunt down all of their severely overdue accounts. Collection agencies have cheap labor and a streamlined system to pursue such accounts. If a collection agency is successful at collecting the money on the account, they usually keep a percentage of what is collected as payment for their services.

Sometimes original creditors sell debts in large portfolios to collection agencies. Several of these companies, called Junk Debt Buyers (JDBs), are now being traded on Wall Street. The companies do not spend much money at all for these debts, sometimes paying cents on the dollar. Even if the debt is not a large debt, they often hire attorneys to send out mass form letters to debtors on the attorney’s letterhead in hopes of collecting. Thus, even if they get a small percentage of the debtors to pay, profits can be very lucrative.

SB 890 would introduce commonsense reforms that will protect all Californians, and level the playing field for responsible collection agencies. On January 31, 2012, the State Senate passed SB 890. SB 890 now goes to the Assembly.

The Hunger Site

The Hunger Site

February 3, 2012 at 3:09 pm

This is a sad commentary on Mark Leno, who wrote legislation solely based on complaints made by a fellow politician , not from a complaint lodged by one of his constituents. This is Mark care of who really counts. And there is already an existing Federal Law governing this issue – it just isn’t being enforced. So I guess we can add another law that won’t be enforced, either.

As bad as collection agencies are, they provide a legitimate service to businesses who are ripped off by chislers who walk away from their obligations.

February 3, 2012 at 2:18 pm

Your article is slanted towards vilifying all collection agencies.

Senate bill 890 seems nothing more than a petty attempt to gain vengence on all agencies for one senators laziness. He ignored the letters. Her ignored the calls. He ignored a Court Summons! Did he appear in court? Did he prove that it was a fraud situation?

Nearly everyone complains about their debts. Most of them claim fraud or some other excuse. The majority of the time the claims are false.

The majority of collection agencies do not do things out of the blue. But you make us all sound like the same criminal enterprise. In my opinion you have writen this article simple to ride the band wagon of current “collection agency hatred stories”. But ofcourse agencies are hated. No one likes to be reminded that they can’t manage their finaces, have gotten in over their heads or simply become a victim of our nations current economic situation. This article shows you lack a true journalist integrity. You show only one side of this story. Did you interview the collection agency or their attorney? Did you research the facts of the debt or of the lawsuit itself? For all you know the agency has the right person. Or… because he has political influence you have decided to do this once side article for the sake of personal fame.