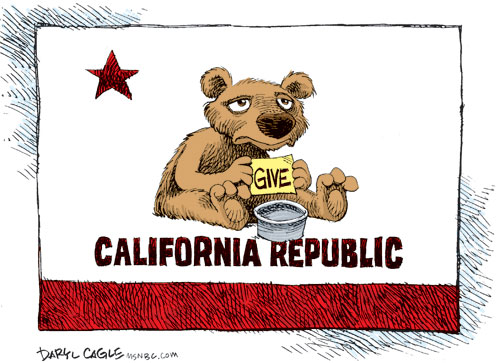

Cartoon courtesy Daryl Cagle, MSNBC.com

March 22, 2010

Fasten your safety belts. It’s budget time again in Sacramento. Prepare for a repeat of last year’s contentious budget battle. California is still one of only three states – Arkansas and Rhode Island are the others – to require a super-majority to adopt a budget. And it still takes a two-thirds super-majority to raise taxes. UC Berkeley linguistics Professor George Lakoff’s California Democracy Act initiative is now circulating; it would enable a simple legislative majority to pass a budget and to raise taxes. However, there is some doubt whether the proposed initiative will be able to gather the necessary 694,354 valid signatures by April 12 to get the measure on the November ballot.

Last budget season, the legislature closed about 90 percent of the 2009-10 $60 billion budget gap with spending cuts, tax increases, borrowing, federal funds, and one–time budgetary maneuvers. Closing the immediate $20.7 billion budget problem will be even more difficult. The Republicans in the legislature have been united in their refusal to raise taxes. This probably means more deep cuts in education, health, social services, corrections, and transportation.

How bad is the problem? Consider that California has a $20.7 billion deficit in the general fund budget over the next 16 months. California owes $8.8 billion in short-term loans that have to be paid off by June, and over $120 billion in outstanding bonds and interest that will be paid over decades. The state’s pension fund, CalPers, has $16.3 billion more in liabilities than assets, plus California also faces a $51.8 billion expense for the health and dental benefits of state retirees and future retirees.

Bottom line: California has the lowest credit rating of any state in the nation, just above junk bond status. One major problem is the rise in California’s debt-service ratio (DSR). That is, the ratio of annual general fund debt–service costs to annual general fund revenues and transfers. This is often used as one indicator of the state’s debt burden. The higher it is, the more rapidly it rises, the more closely bond raters, financial analysts, and investors tend to look at the state’s debt practices, and the more debt–service expenses limit the use of revenues for other programs. Debt servicing is projected to comprise 9 percent of general fund revenues by the end of 2014-15. According to Bloomberg News, the market believes a developing country like Kazakhstan, with about 15.7 million people, is less likely to default on its debt than California, which is the eighth largest economy in the world.

The over 9 percent DSR is considerably higher than it has been in the past. In part, this reflects the sharp, recent fall–off in general fund revenues, which drives up the ratio for a given level of debt service. To the extent additional bonds are authorized and sold in future years beyond those already approved, the states debt–service costs and DSR will be higher. Until California’s fiscal house is put in order, the prudent course would be to avoid taking on new debt, even for worthwhile projects such as the $11.1 billion bond to finance an overhaul of California’s water system, and the $5.5 billion of debt already approved but not yet sold.

Unfortunately, I see no serious calls for reforms in California’s fiscal management by the Governor, the legislature or even the candidates for governor. Where is the movement to change the inherent inequities in the Proposition 13 tax scheme, to change the two-thirds rule to pass a budget and to raise taxes, and to reform the initiative process? When the dust settles over the 2010-11 budget, nothing will be done to put California’s fiscal house in order and we will again face the same budget battle next year.

It will take a Constitutional Convention to seriously address California’s dysfunctional fiscal problems because it won’t happen in the legislature or by the governor.

The Hunger Site

The Hunger Site

March 22, 2010 at 3:09 pm

I had no idea Lakoff was the author.

March 22, 2010 at 10:38 am

Feeling pioneer?

Get ready to home-school your kids and expand that back yard boutique garden. Boil your water and do your own reloads on ammo. Keep plenty of line and fish hooks and a couple of basic dental tools in your shaving kit.

You already know how to make your own beer, wine and whiskey and grow your own weed.

And, keep a guitar, harmonica and flute on hand.

h.

March 22, 2010 at 8:38 am

The constitutional convention was scotched because enough Democrats realized that they could not hedge against the risk that a mobilized right wing would dominate the proceedings and elicit truly regressive reforms.

The problem here is that the Democrat Party wants to walk down both sides of the street, that it expects to play the role of standing up for the little people while bending over backwards to provide supply side support to corporate interests.

Like in health care, they will talk a good game, and when they win they will move the goalposts. The solution to California’s gridlock is for the Democrat Party to play for keeps on behalf of Californians rather than carry corporate water.

This problem is not structural, just as the filibuster is not the structural problem in DC. This problem is one of personnel.

-marc