The budget that ate San Francisco

The Budget That Ate S.F: A Study of San Francisco Taxation

and Spending is sponsored by the Committee on Jobs. Thanks to

Baha Hariri, the San Francisco Office of the Controller, the members

and leadership of the San Francisco Building Owners and Managers

Association, and the Mayor's Office of Economic and Workforce

Development. A special thanks to Christopher Wright for his tireless

efforts in shedding light on excessive city spending and his dedication

to a better San Francisco.

July 18, 2006

INTRODUCTION - "Round Up The Usual Suspects"

As Captain Renault in Casablanca, the actor Claude Rains made

himself immortal by telling his men to "round up the usual

suspects." Years later, the film "Usual Suspects"

would borrow the phrase and give birth to another well known character:

Kaiser Soze, the unseen crime lord responsible for everything,

but seen by no one. Often referred to as conventional wisdom,

urban legends or old wives' tales, these half-truth/half-fiction

morality tales make for great cinema because of what they say

about society. We often believe what we hear, especially if we

hear it over and over again.

A good example of urban myth overtaking reality can be found

in an Francisco, where the City's ideological government leaders

ave misled the public for years into believing that the business

ommunity contributes very little financially to help run the City.

othing could be further from the truth. The reality is that the

an Francisco Board of Supervisors has, for years, leaned on the

downtown" to support its runaway municipal spending. Year

after year, San Francisco's elected officials struggle to balance

the City budget, failing to control spending and continually seeking

new revenues from businesses and residents in the form of taxes

and fees. Despite the fact that the City is still only slowly

recovering from a serious economic downturn, San Francisco's fiscal

year (FY) 2005-06 budget reached an all-time high of $5.3 billion.

That didn't stop City Hall from proposing a FY 2006-07 budget

that calls for even more spending, with a more than 8% increase

totaling a massive $5.73 billion.1

All the while, the City has consistently dragged its feet on

conducting key audits of departments and economic analyses of

pending legislation-even though voters approved Proposition I

two years ago requiring just such analyses. The San Francisco

Health Department, for example, enjoys a budget in excess of $1.2

billion, but has never been fully audited.2 The Board of Supervisors

routinely considers and attempts to impose new fees and taxes

on businesses, again, without conducting the economic analysis

that Proposition I requires. Though the City has adopted hundreds

of pieces of legislation since Prop. I's passage, it has conducted

only a handful of economic impact reports.

The dire lack of cost containment, however, doesn't appear to

concern the majority of San Francisco's elected leaders and special

interests. They simply maintain that the problem is revenue. Falling

back on their favorite urban myth, they try to convince us that

businesses can pay more, they don't pay enough…they must

pay their fair share.

This paper is designed to combat what amounts to nothing more

than a damaging urban myth, one that has had far-reaching economic,

financial and political ramifications for businesses, residents

and taxpayers. This study examines revenue from different taxes

collected by the City and County and analyzes the contributions

specific to the downtown region, where the majority of the City's

retail and commercial businesses operate. The results are troubling.

San Franciscans enjoy a host of expensive city services paid

for by local tax dollars that, as the data shows, are generated

in large part by the downtown. It is quite astounding that a region

making up just 5% of the City's total area provides more than

a third of total General Fund revenues-$1.2 million every day

to the General Fund from just the major taxes. The downtown pays

more in taxes than any other area of San Francisco, with the bulk

coming from local businesses already struggling to "make

it" in a city known for its notoriously high cost of living

and exorbitant cost of doing business.

The amount of taxes actually paid is much more than what is noted

above, yet hundreds of millions of dollars in revenue go directly

to other funds such as the SF Unified School District and other

local government agencies called enterprise departments, including

the airport, Public Utilities Commission, and the public transportation

system. The above figure only accounts for the portion of taxes

that end up in the General Fund, the City's main operating account.

Moreover, this study did not consider downtown's hefty payments

into the City's elaborate fee system, which brought in more than

$350 million last year alone in governmental charges and more

than $1.68 billion in business-type fees.3 For these reasons,

this report dramatically understates the total financial contribution

that downtown makes to the City. However, it offers a snapshot

of the many millions of dollars that a small cross section of

the City provides, and how the political rhetoric of "fair

share" is being misused to mask City Hall's catastrophic

spending problem. The reality is that there can never be enough

revenue for a city whose budget grows by more than a billion dollars

every few years.

A LOOK AT THE NUMBERS - Locating Downtown

Geographically, the downtown is situated in the northeast corner

of the City and comprises about 2.5 square miles of San Francisco's

47 total square miles, or roughly 5% of the City in terms of area.4

This small region contributes more money to City coffers than

any other part of the City and, in some cases, more than the rest

of the City combined.

Revenue Generated By Dowtown

The City and County of San Francisco's ever-growing budget is

funded largely through billions of dollars in taxes and revenue

from fees, licenses and fines, among other funding sources. Not

all of this revenue goes into the City's main operating account-

the General Fund. Portions are appropriated to fund other specific

services, such as transportation and education.5 This study looks

at the following major taxes, their contribution to the General

Fund and the hundreds of millions of dollars the downtown region

contributes:

- Payroll Tax

- Commercial Property Tax

- Business Registration Tax

- Hotel Tax

- Franchise Tax

- Sales Tax

- Utility Users Tax

- Parking Tax

1. PAYROLL TAX

Downtown paid $132 million in payroll taxes in FY 2004-05, accounting

for nearly half of the City's entire payroll revenue stream.6

San Francisco's General Fund collected $284.41 million in payroll

taxes in FY 2004-2005 by levying a 1.5% tax on businesses for

all payroll expenditures. The downtown's contribution of $132

million makes it San Francisco's chief source of payroll tax revenue.

In other words, 5% of the City's geographic area accounted for

roughly 50% of the City's payroll tax. It is important to note

that small businesses are exempt from this tax and thus the City's

revenue depends solely on local medium- to large-size businesses.

2. BUSINESS REGISTRATION TAX

Downtown contributed more than one quarter of the revenue that

the City receives from the business registration tax.7 In addition

to payroll taxes, San Francisco companies must also pay an annual

business registration tax based on their computed payroll tax

liability. In hard dollars, the downtown in FY 2004-05 contributed

about $2 million of the total $7.36 million the City collected

from the business registration tax.

3. FRANCHISE TAX

Downtown accounted for nearly ALL of the revenue collected.8

The City and County of San Francisco in fiscal year 2004-05 collected

$12.79 million in franchise taxes from companies that pay to use

the City's streets, or rights-of-way. This fee allows them to

provide services to residents, such as cable, phone and Internet

service. Of that amount, downtown paid $12.53 million, or nearly

all of the revenue the City received from the franchise tax.

4. UTILITY USERS TAX

Downtown businesses paid more than $16 million in utility users

tax in FY 2004-05.9 San Francisco's utility users tax, which is

collected by PG&E and then paid directly to the City on a

monthly basis, is a 7.5% tax levied on all businesses for their

use of energy. Residential users are exempt. Last year, the City

collected $72.57 million from the utility users tax, with downtown

businesses paying $16.1 million.

5. COMMERCIAL PROPERTY TAX

Downtown paid more than $100 million in commercial property tax

in FY 2004-05.10 The City's General Fund received roughly $154

million in revenue from commercial property taxes in FY 2004-05,

with the downtown region contributing about $101 million. In other

words, the downtown generated more than twice the commercial property

tax revenue as the rest of the City combined.

6. HOTEL TAX

Downtown generated more than $87 million in hotel tax payments

in FY 2004-05, representing 80% of the entire revenue stream.11

The City and County of San Francisco collects a 14% hotel tax,

also known as the transient occupancy tax, on all hotel room charges.

The tax has grown from an initial rate of 6% to its current level

of 14%, making it the highest hotel tax rate of any Bay Area city

and the second highest hotel tax rate in the state.

In FY 2004-05, the City's General Fund received $109 million

in hotel tax revenue, with the downtown contributing 80%-90%,

according to industry experts. Using even the most conservative

percentage (80%), the downtown generated more than $87 million

of the $109 million in General Fund hotel tax revenue in FY 2004-05.

7. SALES TAX

Downtown generated more than $41 million in General Fund sales

tax revenue in FY 2004-05.12 San Francisco's sales tax rate of

8.5% is the highest in the Bay Area. In fact, it is the highest

sales tax rate of any major California city. The tax is imposed

on the sale of all tangible personal property, including business-tobusiness

sales. It is responsible for funding the City's schools, transportation

system and general local government.

The downtown is the City's chief generator of sales tax revenue,

bringing the General Fund $94.69 million in FY 2004-05. Again,

this represents only the portion of tax revenue that goes directly

to the City's General Fund. It does not include large portions

that are paid to state and local transportation and school funds.

Of the $94.69 million General Fund portion, the downtown was responsible

for generating $41.66 million, almost as much as the rest of the

City combined.

8. PARKING TAX

Downtown generated $26 million in General Fund parking tax revenue

in FY 2004-05, or 78% of total revenue.13 The City and County

of San Francisco charges the highest parking tax rate in the country,

almost triple that of the City of Los Angeles and outpacing even

downtown Manhattan. Most cities do not charge a parking tax, including

the cities of San Jose, Sacramento and San Diego. In addition,

San Francisco's enormous tax rate of 25% is five times the state's

average 5% parking tax rate.

The City collected $55.15 million in parking tax revenue in FY

2004-05, of which $33.09 million went to the General Fund and

$22.06 million went directly to the Municipal Transportation Agency

(MTA). Considering just the General Fund portion and not the millions

paid to the MTA, the downtown accounts for almost 80%, or about

$26 million, of General Fund parking tax revenue.

SAN FRANCISCO'S EXPLODING BUDGET - A Trend That Must Stop

From a policy perspective, the Board of Supervisors and special

interests have continually turned a blind eye to the inefficiencies

in municipal services delivery and the lack of cost containment

in City government. Instead of addressing these major issues as

taxpayers expect, some elected officials prefer to blame the City's

perennial budget deficit on the downtown not paying its alleged

"fair share." The graph below reaffirms the serious

spending problem in San Francisco as budgets rise year to year.

Even with the City's continued decline in population, San Francisco's

budget continues to grow-the City's rate of spending in FY 2004-05

equated to more than $10,000 every minute.14 In fact, San Francisco's

spending surpasses that of many states. The City and County of

San Francisco outspent the states of Mississippi and Vermont by

more than $1 billion and spent more than double the budgets of

Alaska and Idaho, respectively.15 Yet, the City's budget is set

to grow once again with the Mayor's proposed $5.73 billion FY

06 07 budget, a boost of more than 8%, or $400 million, over the

previous fiscal year's record-breaking budget.16

Figure 1 City Budget Increases

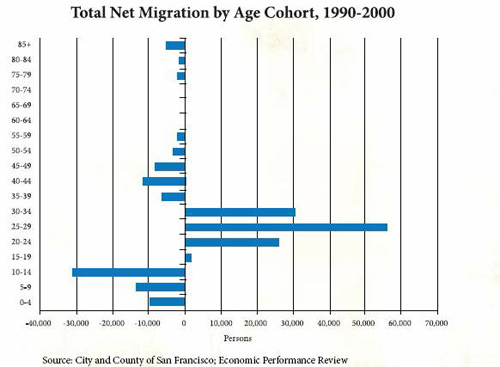

Meanwhile, as cities across the Bay Area and the state continue

to grow, San Francisco continues to lose residents. According

to the Census Bureau, San Francisco's population has now dipped

to roughly 739,000, as residents continue their flight to neighboring

cities and counties. All the while, San Francisco's government

spending has reached all-time highs.

Common sense tells us that with such a steady drop in population,

the City's spending should also fall. Unfortunately, even with

increasing spending and declining population, the City still received

only a C+ rating of its ability to provide needed services, as

documented in the annual City Survey of residents conducted by

the Controller's Office.18

Residents and businesses have become frustrated as they dig deeper

into their pockets to pay for more expensive services, while inefficiency

and waste slowly devour the City's coffers. According to the Controller,

overtime costs for FY 2005-06 are projected to reach $122 million,

which would again set a new City record. Moreover, the overtime

problem is widespread. The City's "Big Six" departments

are all projected to significantly outspend their overtime budgets

in the 2005-06 fiscal year, including Muni ($13.7 million), the

Department of Public Health ($8.5 million), and the Public Utilities

Commission ($4.3 million).

There are also major departments in San Francisco's local government

that have never been fully audited. Even after a request by Mayor

Newsom for an audit of the City's largest department-the Department

of Public Health-with more than 6,000 employees and a budget of

more than $1.2 billion, one has not yet been completed.20 Also,

a growing rate of absenteeism, particularly unexcused absences

at MUNI and the Department of Parking and Traffic, should cause

additional concern among all taxpayers.21

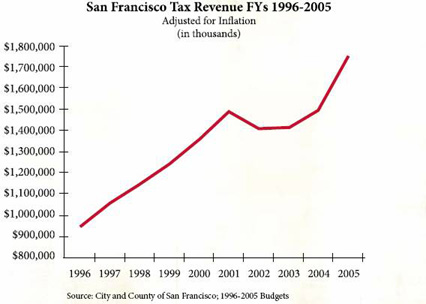

All of this reinforces the fact that San Francisco does not have

a revenue problem. It has a spending problem. In fact, tax revenue

has grown significantly (Figure 2). However, without better spending

controls and stricter enforcement of minimal workplace productivity

standards, there will never be enough. Residents and businesses

paying for these bloated budgets should be asking if the City

and County of San Francisco is doing its fair share.

So, as city leaders maintain their perennial stance that the

City must continue to impose new taxes and fees on the usual suspects

to feed their spending habit, San Franciscans must demand that

their elected leaders impose greater cost and efficiency controls.

Figure 2: Will There Ever Be Enough?

CONCLUSION - Misaligned priorities mean a misaligned economy

Despite its usefulness for fueling poor public policy and runaway

spending, the myth that businesses don't pay their fair share

is no longer sustainable as a political excuse. For one thing,

San Francisco is in danger of losing its so-called "goose

that laid the golden egg" by creating a climate that is unsustainable

for businesses at all levels.

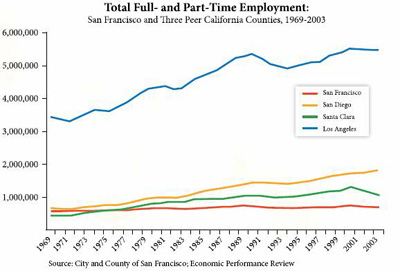

For example, when looking at job growth, the number of jobs in

San Francisco has actually increased only marginally since 1969

(see Appendix A).22 Even worse, the fastest growing job sector

in San Francisco is now referred to as "non-employers,"

or independent contractors. Currently representing 18% of all

private sector unrealistic expectations about the cost of service

delivery combined with a total disregard for how much is available

to spend.

The reality is that San Francisco has a systemic budget problem

that necessitates more revenue every year to fund an insatiable

appetite for creating new programs and hiring more workers without

a sustainable income stream.

While the political rhetoric has focused for years on faulty

assertions that the downtown does not pay its fair share, the

quantitative evidence is incontrovertible that the downtown and

the business community, in general, is indeed a major contributor

to the City's tax revenue stream upon which city services rely.

The employment in the City, independent contractor positions have

increased significantly, while employment has remained virtually

stagnant for more than 35 years. Put simply, the City's tax base

is eroding as the economy shifts from traditional corporate employment

to an economy comprised of "non employers." 23 The future

of San Francisco's economic well-being is in serious jeopardy

given the manner in which the City has chosen to fund its bloated

budgets. By finding new ways to tax, and imposing increasingly

onerous fees on those businesses and residents that remain here,

this erosion will only escalate.

Employment in the City, independent contractor positions have

increased significantly, while employment has remained virtually

stagnant for more than 35 years. Put simply, the City's tax base

is eroding as the economy shifts from traditional corporate employment

to an economy comprised of "non-employers." The future

of San Francisco's economic well being is in serious jeopardy

given the manner in which the City has chosen to fund its bloated

budgets. By finding new ways to tax, and imposing increasingly

onerous fees on those businesses and residents that remain here,

this erosion will only escalate.

If such a trend continues, the City will be left without an adequate

employer tax base to fund services.

As the Board of Supervisors continually passes legislation calling

for the expansion of services, they are creating a crisis in public

trust for our government. Policy and legislation based on ideology

rather than sound planning and management will always require

more revenue. This perpetual need, rather than the real problem

of overspending, has become the focus of discussion-creating downtown

makes up only 5% of San Francisco's total geographic area, but

provides much of the City's critical tax revenue, in some cases

double the amount of revenue collected from the rest of the City

combined.

Although many elected officials are confident that residents

and businesses will stay preferring to dismiss concerns using

a take-it-or-leave-it attitude-this type of governance has a disturbing

impact on the local economy and demographic makeup of the City.

The severe economic swings of boom and bust that San Francisco

has faced over the decades, coupled with the dangerous approach

by policy makers of assuming they can rely on the usual suspects

to supply a never-ending revenue stream, is not in the best interest

of San Francisco and the frustrated taxpayers that call this city

home.

As a result, residents and businesses are leaving and will continue

to leave until San Francisco can provide the quality of life and

services expected from a major metropolitan city with a budget

larger than that of 20 states in the union.

In the end, San Francisco's elected and appointed leaders must

learn to live within their means and stop their over-reliance

on local businesses to support their addiction to spending. The

core business infrastructure of the City should be seen as an

opportunity for economic growth and vitality as opposed to simply

a source of funding for unfettered government spending. San Franciscans

must demand that their elected officials set enforceable standards

to contain costs and that they become more efficient rather than

continuing to seek new and greater revenue through taxes and fees.

The question should not be whether downtown is paying its fair

share, but whether San Francisco, as a city, can better manage

its budget and provide services to its residents and businesses

without increasing taxes annually to pay for it. San Francisco

deserves better.

APPENDIX A

APPENDIX B

END NOTES

1 City and County of San Francisco; Mayor's FY 2006-07 Budget

Proposal

2 City and County of San Francisco; Office of the Controller

3 City and County of San Francisco; 2005 Comprehensive Annual

Financial Report

4 U.S. Census Bureau; www.census.gov

5 City and County of San Francisco; 2005 Comprehensive Annual

Financial Report

6 SF Prospector business data

7 SF Prospector business data and Economagic economic data, www.economagic.com

8 City and County of San Francisco; Office of the Controller

9 PG&E Tax Records

10 Real Quest Database

11 PKF Consulting

12 City and County of San Francisco; Office of the Controller

13 City and County of San Francisco; Office of the Controller

& Data From Local Parking Lot Operators

14 City and County of San Francisco; 2005 Comprehensive Annual

Financial Report

15 FY 2004-05 State Budgets

16 City and County of San Francisco; Mayor's Proposed FY 2006-2007

Budget

17 US Census Bureau; www.census.gov

18 City and County of San Francisco; Office of the Controller

19 San Francisco Examiner (5/27/06); "City overtime costs

soar to $122 million"

20 City and County of San Francisco; Office of the Controller

21 City and County of San Francisco; SF Stat

22 San Francisco recently conducted an Economic Performance Review

to assess current economic and demographic trends.

23 City and County of San Francisco; Economic Performance Review

####

|